Introduction

In today's fast-paced and interconnected world, the global commodity market plays a significant role in driving economic growth and fostering international trade. However, navigating this complex market can be a daunting task, especially for businesses that lack the necessary expertise and resources. This is where commodity trade finance advisors come into the picture, offering valuable guidance and support to unlock opportunities and maximize returns.

What is Commodity Trade Finance?

Commodity trade finance refers to the financial instruments and services that facilitate the trading of commodities, such as oil, gas, metals, agricultural products, and more. It encompasses a range of activities, including financing, risk management, supply chain optimization, and market analysis. Commodity trade finance advisors are professionals who specialize in providing expert advice and assistance in these areas.

The Role of Commodity Trade Finance Advisors

Commodity trade finance advisors play a crucial role in helping businesses navigate the complexities of the global commodity market. Here are some key aspects of their role:

1. Financial Expertise

Commodity trade finance advisors possess extensive knowledge and expertise in finance and commodity markets. They understand the intricacies of trading, risk management, and financial instruments. Their expertise allows them to assess market conditions, identify potential risks and opportunities, and develop strategies to mitigate risks and maximize returns.

2. Risk Management

Commodity trading involves inherent risks, such as price volatility, geopolitical factors, and supply chain disruptions. Commodity trade finance advisors help businesses manage and mitigate these risks by providing risk assessment, hedging strategies, and insurance solutions. They ensure that businesses are well-prepared to handle unexpected events and minimize potential losses.

3. Supply Chain Optimization

Efficient supply chain management is critical for successful commodity trading. Commodity trade finance advisors help businesses optimize their supply chains by identifying bottlenecks, improving logistics, and streamlining processes. They ensure smooth and timely delivery of commodities, reducing costs and enhancing overall operational efficiency.

4. Market Analysis

Commodity trade finance advisors closely monitor global commodity markets and analyze market trends, supply-demand distribution, and pricing patterns. They provide businesses with valuable insights and recommendations based on their analysis, enabling informed decision-making. Their market intelligence helps businesses identify emerging opportunities and stay ahead of the competition.

Conclusion

Commodity trade finance advisors play a vital role in unlocking opportunities and driving success in the global commodity market. Their financial expertise, risk management strategies, supply chain optimization, and market analysis provide businesses with a competitive edge. By partnering with commodity trade finance advisors, businesses can navigate the complexities of the market, mitigate risks, and capitalize on lucrative opportunities.

You may also like

More from this category.

The Power of Tandoor Ovens in Modern Commercial Kitchens

Tooth Extraction in West Delhi – Expert Oral Surgery Care | DentoHub

Vinny Pizza: A Slice of Authentic Flavor with a Modern Twist

County Pizza: Where Local Flavor Meets Legendary Taste

NextGen Diagnostic Imaging

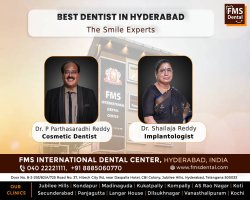

Get the Perfect Smile with the Best Orthodontist in Langar House at FMS Dental

Best Dentist in Hyderabad – Patient-Focused Care at FMS Dental

Why Selenium Is the Most Popular Tool for Web Automation?

Anti-Aging Treatments: Modern Solutions for Youthful, Healthy-Looking Skin