Embarking on the journey to homeownership is equally exhilarating and nerve-wracking, particularly for first-time homebuyers in the eclectic states of New Jersey and Pennsylvania. Amidst the excitement, it's crucial to put protection at the forefront of your investment—and that's where New Jersey title insurance comes into play. Grasping the ins and outs of this safekeeping measure can be the difference between a dream home and a legal nightmare. Loyal Abstract steps in as your ally, offering robust title insurance services to safeguard your slice of the American Dream in these vibrant states.

One immediate concern most first-time buyers have is the unforeseen complications that could arise after purchasing a property. Unlike car insurance, which covers future incidents, title insurance is a one-time purchase that protects you from disputes over property ownership and invalid deeds from the past. With real estate's fluctuating fortunes, having a title insurance policy is your shield against potential title defects lurking in the background of your new abode.

The beauty of title insurance lies in its comprehensive nature. Imagine buying your new home only to discover there are outstanding liens from a previous owner or worse claims on your freshly minted property. Title insurance is your bulwark against these often-hidden hazards. It works retroactively, not just looking out for your future peace of mind but also delving into the history of the property to ensure it’s as crystal clear as your intentions to make that house your home.

Moreover, homebuying is a realm filled with complex legal documentation, which can prove daunting. Title insurance provides a layer of due diligence, verifying that the property's legal paperwork is properly filed and untangled from errors. The quiet joy of moving into a new home should never be marred by sudden legal disputes or claims forcing you to prove your right to the property.

Then, there's the financial fortitude aspect. Investing in a home is likely the most significant financial decision you will make. While unpleasant to consider, fraud and forgery can creep into real estate transactions. Title insurance is your fortress against such misfortune, providing an assurance that you won’t be left out in the cold, fighting battles over your rightful ownership.

As you navigate these uncharted waters of homeownership, remember the worth of locally-knitted expertise. The laws of the land vary, and specialized knowledge of New Jersey title insurance ensures that you're getting guidance tailored to the intricate laws and practices of the Garden State. Companies like Loyal Abstract have become indispensable, blending local savvy with comprehensive support.

In winding up, the argument for title insurance for New Jersey homebuyers is clear as day. It's not about if you'll need title insurance but when. Investing in such protection guarantees not only a smoother transition into your new home but also the stance that you’re fully armed against the old ghosts of property disputes.

So, why leave your home's history to chance? Take the reins and ensure your first bold step into homeownership is shielded with the security of title insurance. Contact Loyal Abstract today and let us provide you with top-tier title insurance services that support first-time homebuyers across New Jersey and Pennsylvania. Secure your investment, your peace of mind, and your future. Because when it comes to your home, playing it safe is the smartest move you'll ever make.

You may also like

More from this category.

The Power of Tandoor Ovens in Modern Commercial Kitchens

Tooth Extraction in West Delhi – Expert Oral Surgery Care | DentoHub

Vinny Pizza: A Slice of Authentic Flavor with a Modern Twist

County Pizza: Where Local Flavor Meets Legendary Taste

NextGen Diagnostic Imaging

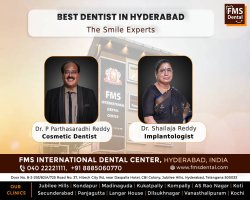

Get the Perfect Smile with the Best Orthodontist in Langar House at FMS Dental

Best Dentist in Hyderabad – Patient-Focused Care at FMS Dental

Why Selenium Is the Most Popular Tool for Web Automation?

Anti-Aging Treatments: Modern Solutions for Youthful, Healthy-Looking Skin